NAV: 172.76 (30.06.2025)

ISIN: SE0005218880

Bloomberg code: n/a

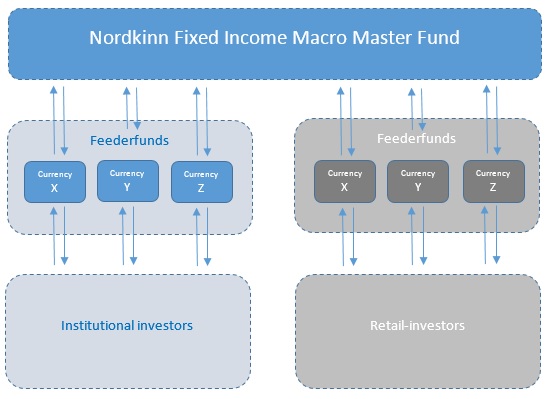

Investments in Nordkinn Fixed Income Macro Master Fund is investible through several different feeder funds. The mechanisms of the master / feeder fund structure is as illustrated below:

There are several different feeder funds available, which are denominated in different currencies. There are also different alternative Feeder Funds with each currency according to the minimum investment amount. All funds offer the same liquidity terms but they require different minimum investments and charges different fees based on the minimum investment amount. For more information regarding available feeder fund currencies please contact our investor relations team.

As the master fund is denominated in SEK, the feeder funds are actively hedged through currency swaps within each feeder fund. The feeder funds maximizes the exposure to the master fund.

All active management occurs in the master fund. On each ‘Trading Day’ (at month-end) the net of gains / losses during the month in the master fund is distributed pro rata among all feeder funds in relation to how much of each feeder fund invested in the master fund.

Fees are charged at the feeder fund level. There are no fees at master fund level, where only the cost of trading in financial instruments arises. Under Swedish law, the fund company may not charge fees in addition to the fixed and variable charges that apply to feeder fund level.

The benefits of a master / feeder fund structure is cost efficiency whereby all feeder funds are consolidated into one overall master portfolio, reducing transaction and administrative costs. Furthermore, the investor can choose the desired currency exposure and thus also obtain full insight into how well the currency hedge is implemented. Furthermore, a master / feeder structure enables the individual hurdle rates related to each feeder fund so that the hurdle rate for a feeder fund is set to a relevant rate for each currency.

Finally, the structure ensures fair and equal treatment of all investors.